Lumon’s Digital Evolution – From MVP to Market Leader in Fintech

Introduction

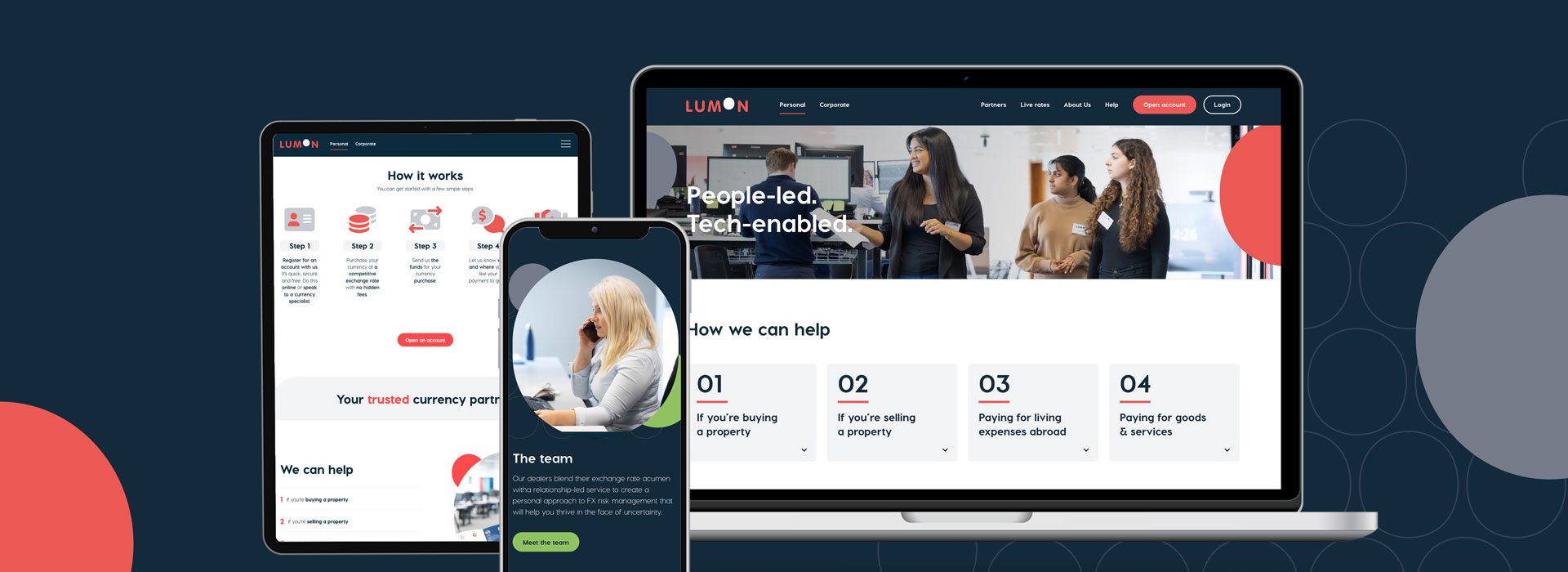

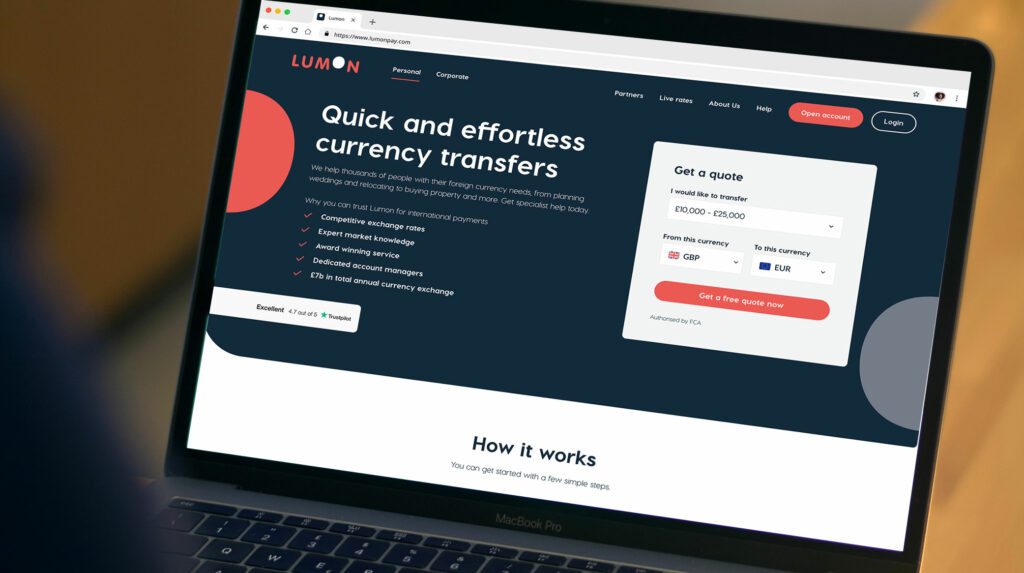

Lumon Pay, (offering quick, effortless and secure online currency exchange), journey began with Polar London two years ago with a vision to consolidate four distinct brands into one cohesive online identity.

Partnering with Polar London, they aimed to create an MVP (Minimum Viable Product) brochure-ware website, marking the start of a transformative digital journey in the Fintech space.

The Initial Brief – Lumon Pay’s Digital Evolution

The initial brief was a challenging yet exciting venture: to merge four separate entities into a single, powerful online presence. This initial phase focused on developing a streamlined, user-friendly website that served as a consolidated platform for Lumon’s diverse services. You can checkout the original case study here.

A Deepening Partnership

Over time, this partnership evolved, with Polar London becoming Lumon’s steadfast digital partner.

This collaboration has been marked by:

- A Dedicated Team of Digital Experts: Polar’s cross-functional team, comprising of UX specialists, designers, and technologists, has been instrumental in continuously enhancing Lumon’s digital footprint.

- Regular Strategy and Goal Setting: Working closely with Lumon, Polar sets quarterly KPIs, ensuring that every digital strategy aligns with Lumon’s evolving business objectives.

- Ongoing Maintenance and Optimization: Regular website maintenance, performance tracking, and reporting keep Lumon’s digital presence agile and responsive to market changes.

- Technical Advisory and Integration Support: Polar provides crucial counsel on integrating third-party APIs and platforms like MS Dynamics, ensuring seamless digital operations.

Targeted Audience Engagement and Content Strategy

Polar’s deep understanding of Lumon’s business enabled the identification and engagement of new audience segments. This involved:

- Crafting tailored content and dedicated web pages.

- Enhancing user experiences to cater to these newly identified sectors.

Results

The enduring partnership between Lumon Pay and Polar London has culminated in tangible, impactful results, reflective of the strategic focus on acquisition readiness in the Fintech sector:

- Engagement and User Base Growth:

- Sessions: We strategically aimed to reduced session time, with improved UX. Resulting in a 2.85% decrease in session time, indicative of heightened user experience. (getting users where they wanted to be, quicker)

- Users: There was a 12.43% rise in users, demonstrating successful expansion in Lumon’s market reach.

- New Users: Growth in new users by 7%, highlighting effective outreach and market penetration strategies.

- Enhanced User Experience:

- Simplified navigation and improved mobile responsiveness led to a 15% increase in average session duration and a 42.44% decrease in bounce rate.

- Strengthened Brand Messaging:

- Clearer value propositions and enhanced brand storytelling

- Optimised Conversion Rates:

- Clear CTAs, streamlined account opening, and competitive pricing contributed to an increase in lead generation and conversion rates

*Results are based on 1 quarter comparison to another in 2023

- Acquisition Objectives:

- The improved engagement metrics are not just numbers; they represent a strengthened foundation for any acquisition strategy. In the Fintech sector, where growth and consolidation are often achieved through acquisitions, these metrics serve as key indicators of the company’s health and attractiveness to potential acquirers.

- Lumon’s enhanced digital presence, facilitated by Polar London’s expertise, positions the company as an attractive target for acquisition, with a robust, active user base and a highly engaging online platform.

Conclusion

The collaboration between Lumon Pay and Polar London has been a strategic success, Lumon Pay’s – digital evolution has significantly boosted thier online metrics that are vital in the context of any future acquisitions in the Fintech industry. This case study exemplifies how targeted digital strategies can not only improve user engagement but also align a company for future growth opportunities.

Key Takeaways

- Focused Digital Strategy: Key to driving growth and preparing for future acquisition in the Fintech sector.

- Measurable Results: Essential metrics for evaluating success and attractiveness in the acquisition process.

- Strategic Partnership: The value of a long-term digital partner in navigating and achieving business objectives in the dynamic Fintech landscape.